Navigating market volatility

In stark contrast to most of the past decade, the first few months of 2020 have delivered a large increase in market volatility. A big factor in this has, of course, been the emergence and spread Covid-19.

When investors establish an investment portfolio, usually with the help of a qualified adviser, the process involves taking a considered amount of investment risk tailored to achieve a set of goals and objectives. As part of that process, investors are usually advised that risk is not always positive. Markets will go up and down, but, on average, they go up. So, when markets do fall – which we expect, and which is already factored into our long term projections – investors are often best advised to sit tight.

Even in highly volatile times, diversification still provides benefits. Investors holding a mixture of shares and bonds will find that bonds have generally been insulated from this decline, and high-quality bonds have even made small positive gains during this period, helping offset some of the weakness in the share markets. Even within global share markets, not all companies’ share prices react the same way in the same environment.

Historically, events like the Covid-19 outbreak are much better buying opportunities, than selling opportunities. When your favourite store has their annual sale, people rush in to buy up the bargains. But in the share market – particularly in a climate of fear - when we see shares suddenly being offered at a significant discount, many investors have an urge to sell. It’s emotionally understandable, but it’s also entirely contrary to an optimal investment strategy. When shares are offered at a discount, history tells us we should be rushing out to buy these, too.

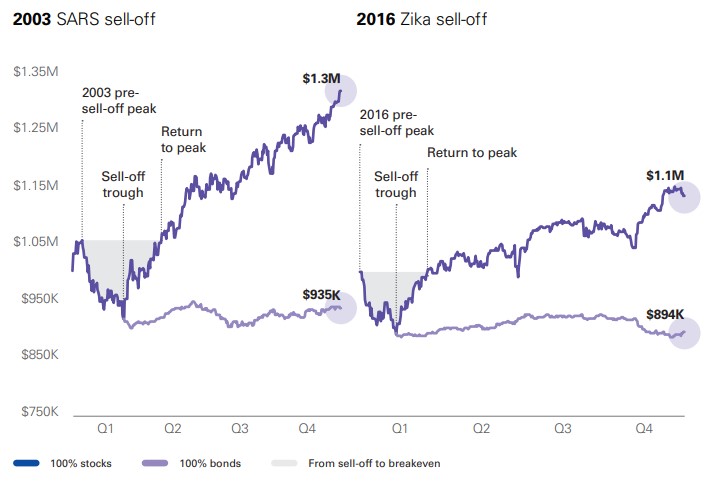

While they are not exact parallels, the market responses to the SARS coronavirus in 2003 and the Zika virus in 2016 offer useful lessons. In both cases, investors who sold on bad news and falling prices missed significant rebounds that very shortly saw share markets back to, and beyond, prior levels.

Synergy’s response

Our administration team will continue to provide normal services, working from home between 8 am and 5 pm, Monday to Friday. All services, including deposits, withdrawals and processing new applications, will continue as normal.

Staff are fully enabled with mobile devices and a secure portal through which to access all Synergy data and required communications. Our main suppliers have also initiated their own business continuity plans and can operate their technology remotely in such a way that there will be no disruption of service to Synergy.

What this all means is that there will be no interruption to the ongoing monitoring and administration of the Synergy Investments Programme. We are able to serve both advisers and clients now and going forward.

Synergy is monitoring portfolios daily. The result of the large fall in global share markets is that many portfolios are currently overweight bonds and cash and underweight shares.

It is important to note that, while Synergy will rebalance portfolios where appropriate, we will not be implementing any short term or tactical asset allocation decisions, such as intentionally redirecting growth assets to cash and then trying to predict when to redeploy it. This is for two main reasons:

Consistent with the investment philosophy behind the Synergy Investment Programme, we do not believe there is robust evidence to suggest higher returns may be available from attempting market timing activities.

Such actions would be in contravention of the explicit policies and procedures adopted by the Synergy Investment Programme.

Rather, Synergy’s approach is to consistently maintain the risk characteristics of investor portfolios, so that investors get the returns available to them for the level of portfolio risk recommended by their advisers.

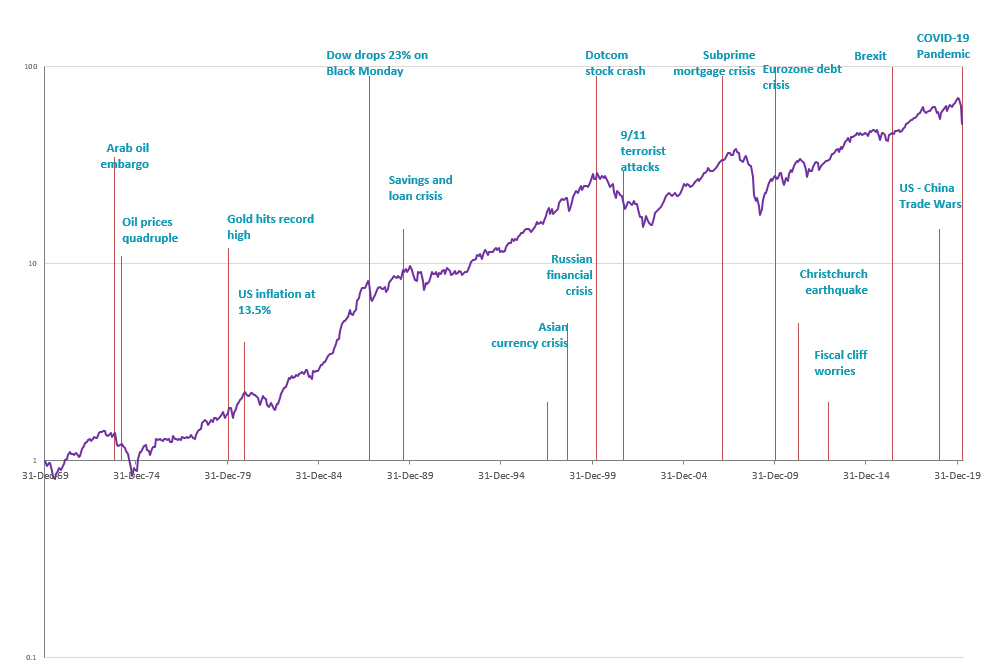

And finally, no matter how uncomfortable things may feel today, this too will pass. As the next chart highlights, history is littered with events which had major and unforeseen impacts on markets. Some of these events, like the Global Financial Crisis, lasted for more than a year, some, like the initial Brexit referendum announcement, lasted for just a few weeks. No one knows how long the market uncertainty relating to Covid-19 will last. But one thing we can point to is that through all of these highly unusual and impactful events in the past, global share markets have always recovered and thrived.

So, take care of the things you can control. Talk to your adviser if you need to, or if your circumstances have changed. Take comfort that markets, as they have so many times in the past, will be able to weather the current storm.

On behalf of Synergy Investments, please stay safe and look after your loved ones.

Warm regards,

Synergy Investments