Quarterly market commentary - June 2021

It still seems extraordinary that something we knew virtually nothing about just 18 months ago, has so utterly dominated global news, our feelings of economic and personal wellbeing, and the normal functioning of our daily lives, ever since.

Of course, we are talking about Covid-19.

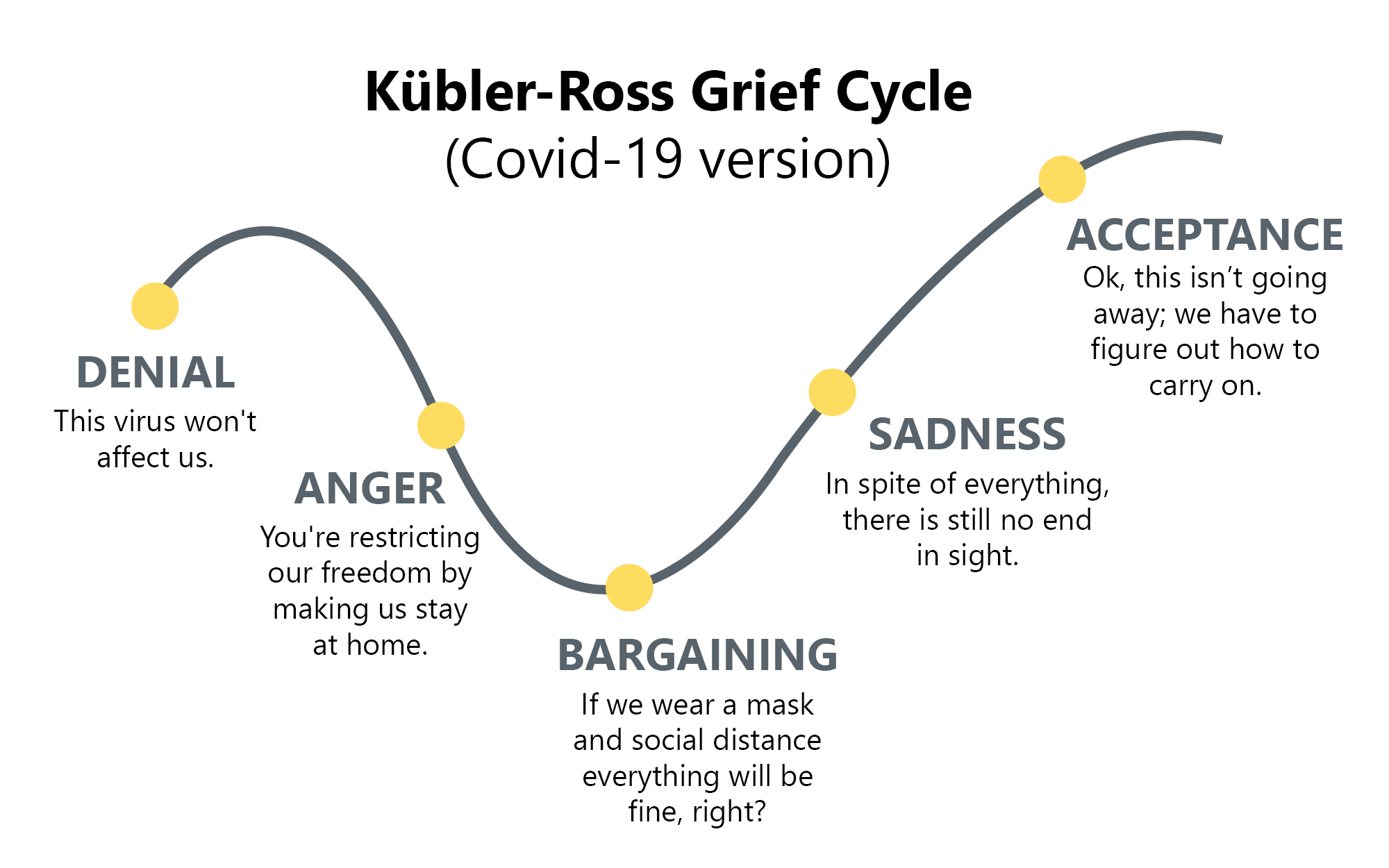

Given the highly unusual circumstances surrounding the pandemic, the evolution of our collective response to it has conformed quite closely to the five stages of grief outlined in the Kübler-Ross Grief Cycle(1):

While individual countries have been wrestling with various approaches to Covid-19 suppression or elimination, an emerging international theme in recent weeks has been a move towards Stage 5 — Acceptance. This theme, propelled by rapidly advancing vaccination programmes internationally, marks another important step on the global road to recovery.

As this mindset increasingly takes hold, our current ‘blunt instruments’ of rolling lockdowns and blanket travel bans will eventually be replaced by measured pragmatism. As vaccination rates continue to grow and the global economy continues to turn its attention towards living more effectively with Covid-19, it also reinforces the likelihood that the global recovery currently underway, may have more upside to come.

The strong global economic growth evident in recent quarters is not difficult to understand. Fiscal policy (government spending) and monetary policy (interest rate management) are both still highly stimulatory, and households in many countries have also had access to increased cash reserves, resulting from lower spending due to lockdowns and reduced travel. These factors, in conjunction with supply constraints has, in recent months, seen demand comfortably outstripping supply. This has resulted in sharp price increases around the globe, with average inflation in May across the 37 OECD(2) countries reported to be growing at its fastest pace since October 2008.

As we write this, the debate continues between central bankers and the general market about whether these recent price hikes are likely to be transitory or something more permanent. For the moment at least, the argument is being won by the central bankers who maintain that today’s inflation spurt is due to nothing more than the unleashing of considerable pent up demand, which is likely to be temporary, and will gradually revert back to a more reasonable level.

What’s been conspicuous over the most recent quarter is that share market investors don’t appear to have been remotely distracted by this debate. Even if there may be a little more inflation on the horizon, it generally means the prices most businesses are charging for their goods and services are going up. That’s not necessarily a bad thing for future business profitability! Of course, it’s not quite that simple. Cost pressures, supply constraints and other factors will all have a role to play in influencing corporate profitability, but a small uptick in prices does not, in itself, mark the death-knell for shares.

Indications are also growing that interest rates may be more likely to increase earlier than initially projected (particularly in New Zealand), although this doesn’t dramatically alter the outlook for fixed income assets. However, if and when interest rates do eventually rise, our expected future returns from this asset class will also tend to rise.

Overall, it continues to be an excellent time to be a diversified investor, and particularly so if you have a reasonable exposure to growth assets. While residential property prices seem to have dominated local headlines recently, those keeping an eye on other traditional (and more liquid) asset classes, like shares, will have noticed some stunning returns coming from these markets as well. For example, in local currency terms, the highly influential US share market (the S&P 500 total return index in USD) delivered 40.8% in the last 12 months alone; by any measure a very significant return.

What’s perhaps more surprising than the strength of these returns, is that they have occurred in a global environment which is still very much focused on waging a war against Covid-19. As nations progressively turn their energies towards constructively managing the ongoing threat of Covid-19 whilst getting on with life, it will be interesting to see how this may further influence investment market returns in the months ahead.

(1) The Kübler-Ross Grief Cycle model was originally used to describe the common stages of grief that applied to terminally ill patients.

(2) Organisation for Economic Co-operation and Development.

For a detailed review of the asset class performances for the quarter, see ‘Key market movements’ or click here to view the full newsletter in PDF.

Disclaimer

Information contained in this newsletter does not constitute personalised financial advice because it does not take into account your individual circumstances or objectives. You should carefully consider whether the Synergy investment portfolios are appropriate for you, read the applicable offer documentation, and seek appropriate professional advice before making any investment decision. The information in this newsletter is of a general nature only. Investors should be aware that the future performance of the Synergy investment portfolios may differ from historic performance. Details are correct as at the date of preparation and are subject to change. The investment objectives and strategies of the Synergy investment portfolios may change in the future.

While every care has been taken in its preparation, Consilium NZ Limited (‘Consilium’) makes no representation or warranty as to the accuracy or completeness of the information in this newsletter and does not accept any liability for reliance on it. The capital value, performance, principal, and returns of the Synergy investment portfolios are not guaranteed or secured in any way by Consilium, or any other person. Investments in the Synergy investment portfolios do not represent deposits or other liabilities of Consilium and are subject to investment risk, including possible loss of income and principal invested.

-

Key market movements - June 2021

The second quarter of 2021 again saw generally positive returns for riskier assets. Many developed nations saw falling rates of Covid-19 infection, resulting in a loosening of restrictions which helped propel economic output and consumer spending. These, in turn, strengthened the outlook for future economic growth and pushed markets higher.

-

Responsible investing trends

New Zealand investors are continuing to show more interest in products with environmental and socially responsible considerations; more and more Kiwi investors want to know where their hard-earned savings are being invested, and that the companies they are investing in operate in a manner that is consistent with their values. The same trend is being observed worldwide.

-

Quarterly market commentary - March 2021

In the context of a long term investment plan, a single year is not a very long time. That said, it’s difficult to write this particular report without reflecting, at least a little, on what an extraordinary year we have all just experienced.