Quarterly market commentary - March 2022

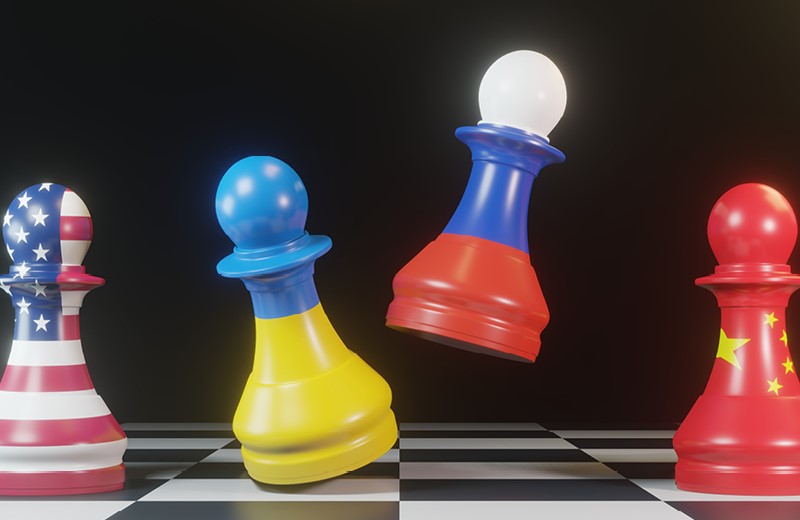

Headlines were dominated this quarter by the war in Ukraine and the humanitarian crisis continuing to unfold there. The implications of the Ukraine conflict quickly fed through into increasingly volatile financial markets, with share markets declining and bond yields rising further (meaning bond prices fell) over the quarter.

Market turbulence, as unpleasant as it is, will eventually ease. In fact, to the extent that lower share prices now imply a higher expected return for owning shares, current market prices could eventually be regarded as a buying signal for longer term investors.

Inflation outlook

Inflation has risen sharply over recent months and what was initially projected to be a transitory phenomenon, has become much more widespread and persistent. There are even signs that the recent acceleration in rising prices is increasingly being seen as the new norm.

That represents a real dilemma for policymakers. With inflation already much higher than forecast, central banks (including the Reserve Bank of New Zealand) are now having to prioritise policy measures aimed at containing inflation. The primary tool at their disposal to achieve this is to raise interest rates.

The repercussions of this are already apparent in New Zealand, with the Official Cash Rate (OCR) having been raised four times (by a total of 1.25%) between 6 October 2021 and 13 April 2022. With domestic interest rates already on the rise, and debt servicing costs rising along with them, this exacerbates the cost of living challenges already faced by many New Zealand families.

However, we should be comforted by the fact that markets react significantly faster than economic indicators. The fall in share prices in the most recent quarter is a result of market participants demanding a lower price for the known risks involved in these investments. In effect, this uncertainty and known bad news has already been ‘priced in’. As we ease through this difficult period – and as long as we don’t see any further big surprises – we can expect investments to deliver positive returns even if economic activity is somewhat subdued.

Central bank policy

After more than two decades of successfully implementing monetary policy to carefully manage inflation expectations within a low and narrow band, central banks are now being compelled to act to ensure that inflation expectations don’t suddenly become unanchored.

The European Central Bank surprised markets during the quarter by presenting plans for a faster than expected reduction in its bond buying programme. Its policy response suggested its concerns about inflation prevailed over all other considerations, including the war in Ukraine, and the deteriorating outlook for economic growth.

The New Zealand situation is particularly acute. With inflation expectations now above the Reserve Bank’s 1% to 3% target band and inflation itself still yet to peak, the Bank is currently expected to progressively move the OCR to almost 3.5% by 2024.

What remains to be seen is how the underlying economy might perform in that environment. Bearing in mind, consumer and business confidence is already at rock bottom, and household cashflow is being reduced by negative real wage growth, high inflation, and the sharp rise in mortgage rates. If economic activity slows quickly as interest rates rise, then the Reserve Bank’s current interest rate projections may ultimately require a downward revision.

Is food the new gold?

Beyond the immense human suffering, the war in Ukraine and the sanctions imposed on Russia create broader issues related to global food production and supply.

At one end of the spectrum are countries with a significant dependency on essential commodities (including mineral products, chemicals, metals and soft commodities) that were imported from Russia and Ukraine.

At the opposite end, there are countries - many of them emerging markets - that could potentially position themselves to fill this gap by exporting more at higher prices.

Food prices and food availability will increasingly be a global economic and political issue. For example, the expected decrease in food production due to reduced spring plantings in Ukraine quickly lifted global wheat prices by over 15% since the start of the war.

Higher grain prices will have a disproportionate impact on low income countries, particularly some countries in Africa, and even India, where spending on food makes up a relatively high proportion of their income. Pressure will mount on these countries to either find alternate sources of supply or to ramp up their domestic production.

However, even if other regions recognise an opportunity to step up their own food production in an effort to fill the void, it can take considerable time to plan, sow, grow and harvest meaningful replacement crops. Quickly replacing the 40 million metric ton supply of Ukrainian wheat would be an astronomical feat.

What can we do?

Maintain perspective and stay patient.

Uncertainty is a constant. We don’t even know what the weather will be next week, and we certainly don’t know what might happen to change the current conflict in Ukraine, global travel and trade, supply chain pressures, concerns about inflation or the ongoing evolution of Covid-19. But we do know that all these unknowns are factored into market prices.

And even though we may not know when or how, history tells us categorically that conflicts always end, pandemics run their course, consumerism and trade generally flourish (on average), and inflation is more commonly able to be controlled within targeted ranges.

We don’t see anything in the world to suggest that this time is any different.

In fact, if we took the Ukraine conflict out of the picture, we would have been looking at a world that was beginning to emerge from the Covid shadow, in which travel and trade were picking up and people and businesses were making longer term spending and investment plans again. All of this will return, even if Vladimir Putin may have pushed the delivery date out a little.

While the investment returns this quarter have been disappointing, they (thankfully) bear no relation to the returns of the comparable quarter in March 2020 when Covid first arrived in the world.

It’s useful to look back at that time because the best strategy then was the same as it is today – ‘don’t worry and stick to your plan’.

We can quickly see the outcome of that approach from the table below:

| Country | Index | 3 months ending March 2020 |

27 months from Jan 2020 – Mar 2022 |

| USA | S&P 500 Index | -19.6% | 45.4% |

| New Zealand | S&P/NZX 50 Index | -14.8% | 5.4% |

| Australia | S&P/ASX 200 Index | -23.1% | 21.5% |

The third column shows how three key market indices performed (in total returns in their local currencies) during the first quarter in 2020. Sadly, a number of unadvised investors chose to exit the markets at this point.

The fourth column shows the performance of those same indexes over a longer period (note: this longer period includes both the poor returns in the first three months of 2020 and the poor returns in the recent quarter).

Holding on to your investments through these periods of heightened market volatility wouldn’t have felt like much fun, but the overall outcome was well worth the effort.

For a detailed review of the asset class performances for the quarter, see ‘Key market movements’ or click here to view the full newsletter in PDF.

Disclaimer

Information contained in this newsletter does not constitute personalised financial advice and does not take into account your individual circumstances or objectives. You should carefully consider whether the Synergy investment portfolios are appropriate for you, read the applicable offer documentation, and seek appropriate professional advice before making any investment decision. The information in this newsletter is of a general nature only. Investors should be aware that the future performance of the Synergy investment portfolios may differ from historical performance. Details are correct as at the date of preparation and are subject to change. The investment objectives and strategies of the Synergy investment portfolios may change in the future.

While every care has been taken in its preparation, Consilium makes no representation or warranty as to the accuracy or completeness of the information in this newsletter and does not accept any liability for reliance on it. The capital value, performance, principal and returns of the Synergy investment portfolios are not guaranteed or secured in any way by Consilium, or any other person. Investments in the Synergy investment portfolios do not represent deposits or other liabilities of Consilium and are subject to investment risk, including possible loss of income and principal invested.

-

Key market movements - March 2022

With the prospect of US interest rate hikes and unrest at the Russia/Ukraine border, there were few places for investors to hide in January, as bond yields spiked and share markets waned. Growth-tilted sectors such as information technology and consumer discretionary bore the brunt of the pain, while the energy sector generally performed strongly.

-

How to feel rich

A new book by Nick Maggiulli explains how to save and invest — and how to strike the right balance between the two. But no matter how much money you are able to accumulate, most people, says Nick, never actually feel rich. Why is that? And what can you do about it?

-

Quarterly market commentary - December 2021

The fourth quarter of 2021 rounded out another year when developed share markets posted strong returns, despite ongoing uncertainties relating to global supply chains, inflation, interest rates and, of course, emerging variants of Covid-19.