Synergy update – Fund manager responses to Ukrainian crises

As we watch events in the Ukraine unfold, many Synergy investors are asking which investment fund managers have exposure to Russian assets, and how they are dealing with these investments going forward?

Synergy portfolios contain eight managers with strategies that potentially have exposure to Russian companies in their funds.

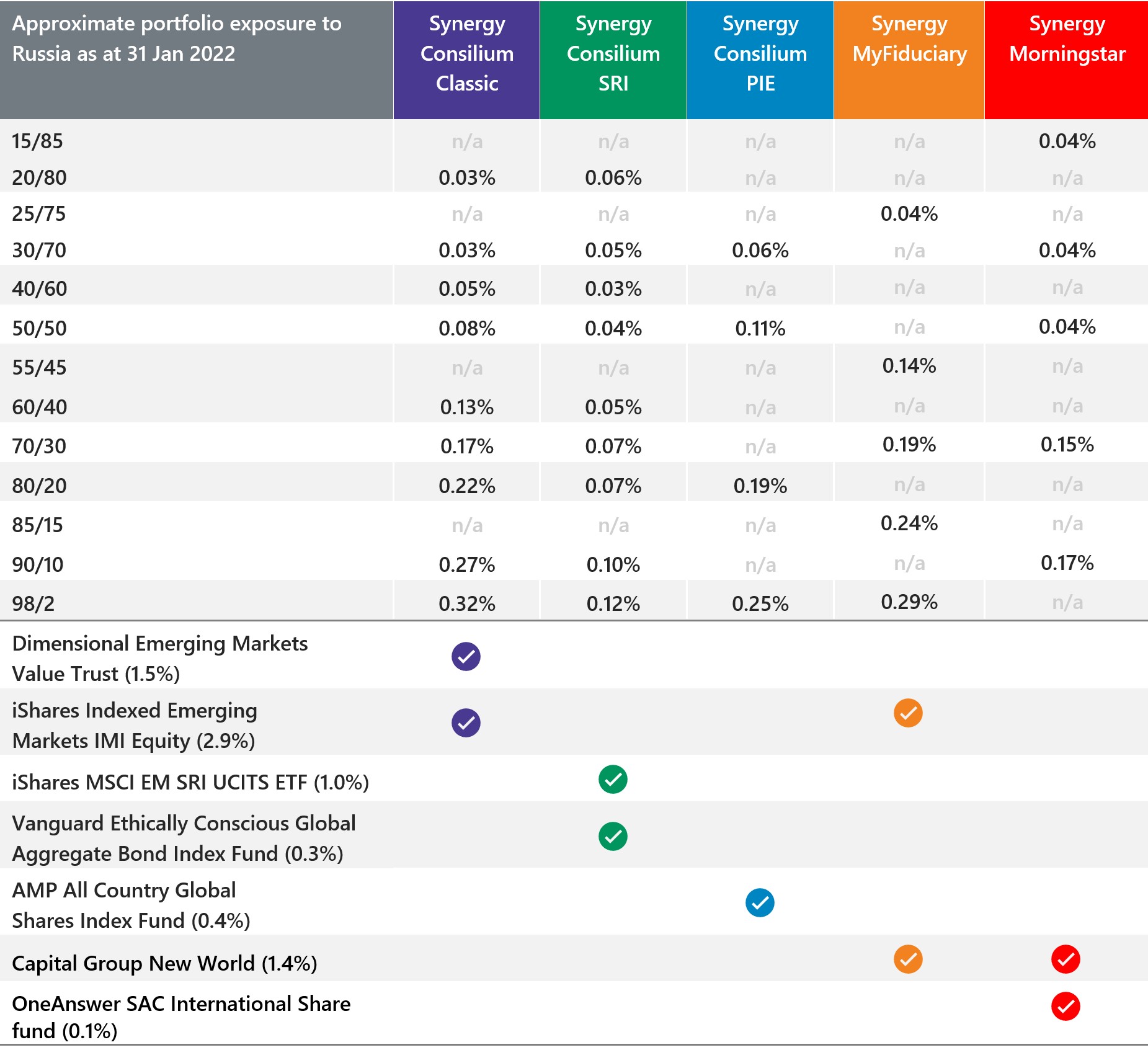

Through these funds, Synergy’s portfolios’ overall exposure to Russia is minimal, between 0.02% and 0.32%. In other words, a current exposure of just 2 cents to 32 cents for every $100 invested. Russian exposure across the different suites is currently as follows:

However, the Russian invasion has led fund managers to quickly review their investment approach. Below we summarise each manager’s response to this unfolding situation. Bear in mind, this is still a very fluid situation, and we expect each approach to be subject to further change, as more information emerges.

|

Synergy Portfolio suite |

Funds with exposure to |

Summary response |

|

Consilium Classic Portfolios |

Dimensional Emerging Markets Value Trust |

Removed Russia from its list of approved markets and will unwind positions. |

|

iShares Indexed Emerging Markets IMI Equity (2.9%) |

Will divest Russian exposures as soon as materially possible. |

|

|

Consilium SRI Portfolios |

iShares MSCI EM SRI UCITS ETF |

Will divest Russian exposures as soon as materially possible. |

|

Vanguard Ethically Conscious Global Aggregate Bond Index Fund |

Vanguard is still deliberating but the CIC will divest from this fund in our next SAA implementation. |

|

|

Consilium PIE Portfolios |

AMP Capital All Country Global Shares Index Fund |

AMP is still deliberating but with MSCI removing Russia from its broad indices, it is now very likely that AMP will be divesting from, or writing off, their Russian exposures. |

|

|

|

|

|

MyFiduciary Portfolios |

Capital Group New World |

Decision to freeze trading on most local Russian exchanges from the beginning of 28th February. Deliberating next steps. |

|

iShares Indexed Emerging Markets IMI Equity (2.9%) |

Will divest Russian exposures as soon as materially possible. |

|

|

Morningstar Portfolios |

Capital Group New World |

Decision to freeze trading on most local Russian exchanges from the beginning of 28th February. Deliberating next steps. |

|

OneAnswer SAC International Share fund |

ANZ is still deliberating, no public response available yet. |

Summary

This is a very dynamic situation with new sanctions and index and fund manager policy changes coming out daily. Synergy has no doubt that as the direct result of Russia’s actions, should they remain on their current course, Russia will be forced to exit the Western financial system and with that exit, Synergy’s exposure to Russian securities will reduce to zero. Our position has been, and will continue to be, to advocate for this outcome in our calls and interactions with the various fund managers discussed above.