Synergy is designed to simplify the investment experience and amplify your returns. The right approach to investing begins with great advice. An adviser learns all about you – your current situation, your goals, your capacity and tolerance for risk – and develops a strategy for you to achieve your objectives.

How Synergy Works

Simplify your life. Amplify your returns.

Synergy provides portfolios that investors can hold for the long term, with a range of options designed to suit your objectives. Your adviser will work with you to implement a strategy designed for your needs, utilising a globally diversified and expertly managed portfolios based on recommendations from industry leading investment professionals.

Synergy portfolios

Synergy offers 30 expertly managed portfolios of different investment styles with a variety of return and risk combinations. The portfolios are developed based on recommendations from industry leading investment professionals and are constructed by Consilium, as a licensed provider of discretionary investment management services. Your adviser will recommend the portfolio most suitable for you depending on your investment needs and preferences.

Highly diversified portfolios

- Evidence based portfolio construction

- Tilted towards sources of higher long term expected returns

- Allocations target low cost and wide diversification

Socially responsible investing

- Evidence based portfolio construction emphasising greater social responsibility

- Excludes companies involved in tobacco, controversial weapons and nuclear weapons manufacturing

- Promotes additional environmental and/or sustainability factors

Emphasis on tax convenience and socially responsible investing

- Evidence based portfolio construction emphasising tax convenience as well as greater social responsibility

- Investments (excluding cash) are restricted to portfolio investment entities (PIEs) only, which may negate the need to file an annual tax return

- Excludes companies involved in tobacco, controversial weapons and nuclear weapons manufacturing

Diversification combined with active management

- Investment portfolios that utilise a “core-satellite” approach and are comprised of a blend of passive and active strategies.

- Core element is comprised of broadly diversified low cost funds

- Satellite exposures include more actively managed funds

What portfolio should I invest in?

Whether you’re just getting started or looking for investment options, your financial adviser will work with you to select a portfolio that is right for you.

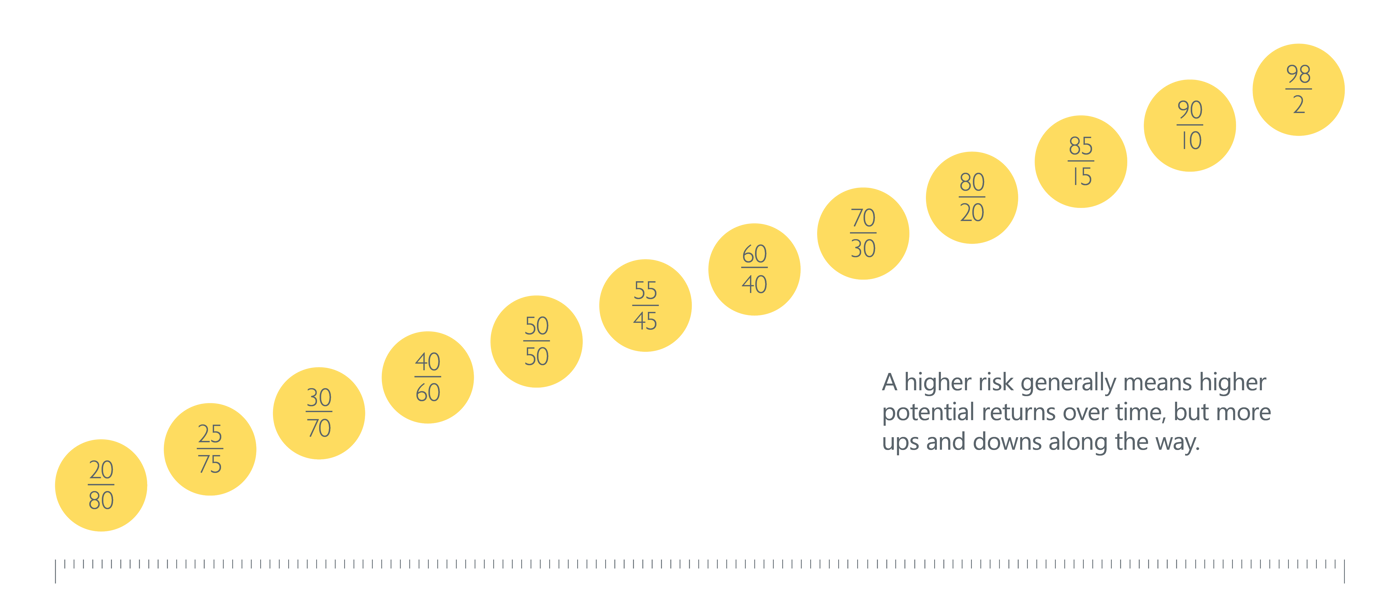

Synergy portfolios contain a mix of growth and income investments in different combinations, and each portfolio is named on the basis of the split between growth assets (like equities and listed property) and income assets (like bonds and cash).

The chart below provides an overview of the percentage split between growth and income assets available in Synergy portfolios. Portfolios at the lower end of the scale tend to have a higher allocation to income assets and are generally lower risk, whereas those on the higher end of the scale have a higher allocation to growth assets and are generally higher risk.

Synergy portfolios are designed to meet different investors’ needs, objectives and appetite for risk.

What's in a Synergy portfolio?

A Synergy portfolio is made up of a diverse selection of growth and income funds. To illustrate this, the chart below breaks down a Consilium SRI 60% Growth / 40% Income portfolio to demonstrate the geographic and underlying security diversification across the equity, fixed interest and cash allocations.

Why use a DIMS?

Synergy is a discretionary investment management service (DIMS) provided by Consilium NZ Limited.

Under a DIMS, we invest funds on your behalf and closely monitor your portfolio. You will receive regular and comprehensive performance, valuation and tax reporting, and have access to view your portfolio online at any time.

A DIMS provides a number of benefits, by:

- Taking full responsibility for monitoring and replacing investments, and rebalancing your portfolio to maintain a consistent risk exposure over time.

- Allowing for efficient and consistent implementation of your portfolio, releasing you from the need to be involved in portfolio administration decisions.

- Giving you access to investments which would not usually be accessible to you if you were investing on your own.

All investments are held through a custodian. The types of investments that are available, and the fees, are all described in the Service Disclosure Statement (SDS) which is available from your adviser.

As a DIMS licence holder, Consilium is regulated by the Financial Markets Authority.

****

Note: The information on this website is intended to be of a general nature and does not take into account your financial situation or goals, and does not constitute personalised advice. See our Terms of Use for full disclosure.